We covered how to publish your ebook on Amazon KDP in detail in our last post. But the big question everyone wants to know is this: HOW DO I GET PAID?

We covered how to publish your ebook on Amazon KDP in detail in our last post. But the big question everyone wants to know is this: HOW DO I GET PAID?

You gotta have several things first before you start seeing any money:

- Sales

- A US bank account

- A W-8BEN

Amazon pays royalties “approximately 60 days following the end of the calendar month during which the sales were made.” This means two months after the month in which you sold your books, so if you made any sales in January, you’ll probably receive your money at the end of March/beginning of April.

Yay, money! Right? Unfortunately, as a Malaysian, it’s not that easy. You’d wish that you could just enter your bank account number and see the money roll in. Nope.

The first we can’t help you with. Sorry. For the other two, here are some general tips on how to get set up.

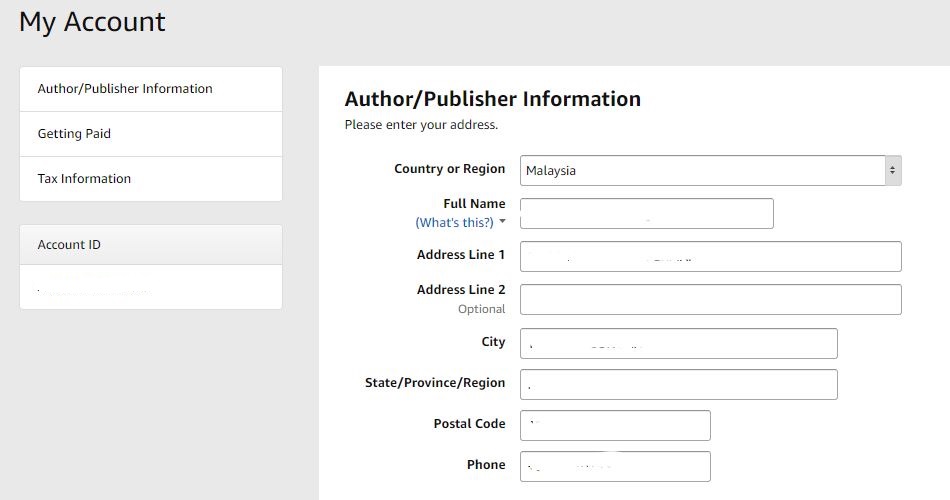

Update your Author/Publisher Information

Go to your account (the link on the top right-hand corner) and fill up your publisher information.

Full name here is your official name, according to your IC. This is NOT your pen name. This information will not be shown to the public anywhere—it’s only for finance use.

I’m pretty sure you know how to fill in your own address so…

Getting Paid

If you’re a super patient person (or you don’t have a bank account with any of the recognised marketplaces), you’ll have to wait for a cheque. Which will only be paid AFTER you reach $100 in the respective marketplace. Note that this is AFTER applicable tax withholding too. Meaning, you’ll need to get about $143.00 in royalties in the US Kindle Store before you’ll get a cheque ($143.00 – 30% = $100.10).

And no, Amazon does not pay out through Paypal, so that’s not an option.

What IS an option is registering with an international bank account like Payoneer or Wise (referral links). With these accounts, you can open a virtual US bank account (and others, but you mainly only need US) so that you can opt for payment via direct debit/EFT. Enter the bank details given by your Payoneer/Wise account into Amazon and voila, you’re getting monthly royalty payments*!

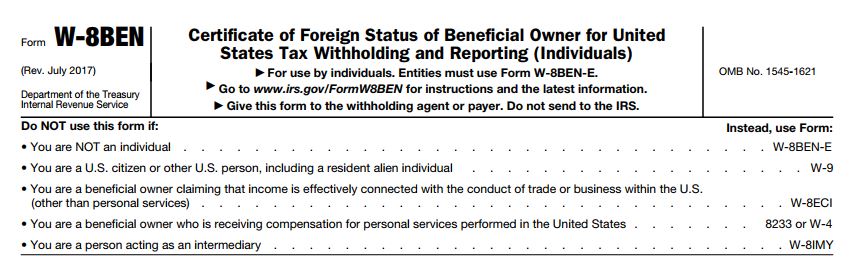

Tax Information

Malaysia does NOT have a tax treaty with USA, so all your royalties is subject to a 30% withholding tax. What you need to do is fill up the W-8BEN, which is a very simple document.

Some websites will ask you to download the form, fill and upload, others (like Amazon) allows you to fill it directly on the site. Most of the stuff is self-evident, but here are the parts you’ll probably have questions about:

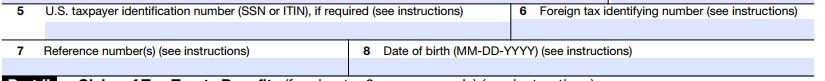

#5 – Leave this blank. The SSN (Social Security Number) is only applicable if you live and work in the US (which, if you’re reading this, you’re probably not) and the ITIN (Individual Taxpayer Identification Number) is only applicable if you’re paying taxes in the US (which, if you’re based in Malaysia, you’re probably not). You CAN apply for an ITIN, but we can’t give you any advise you on that.

#6 – Fill in your Malaysian tax number here (usually SGxxxxxxxxx). If you don’t have a tax number because you’re not taxable yet, you should write “not legally required.”

#7 – Leave this blank. This is usually if you have some funky tax arrangements, which if you’re just trying to self-publish an ebook, you likely don’t.

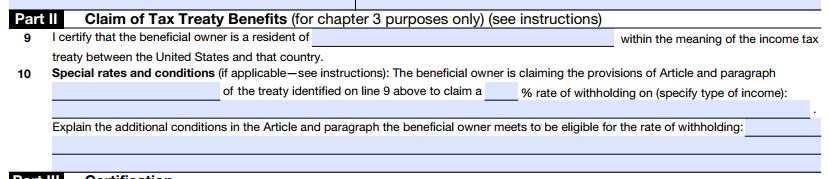

Leave this whole section blank because Malaysia doesn’t have a tax treaty or any special rates to claim. 🙁 You have to pay that 30% withholding, okay? (Not happy? Take it up with the gomen.)

Right! So now this is filled up, sit back, relax, and wait for your money to roll in*!

More questions? Ask away! We’ll dig up some answers for you.

*Assuming you’re making some sales la har. 😉

Hi, I’m Chris from Malaysia. Does that mean i have to set up an account with Payoneer in order to avoid the 30% withholding rate? Then after the money has been transferred in Payoneer account, i have to transfer it out to my Malaysia Local Bank Account right? Thanks.

Hi Chris!

Unfortunately, you’re not going to be able to avoid the 30% withholding rate even if you use Payoneer because Amazon would take off the 30% before transferring your royalties. This is regulated when you fill up the W-8Ben and isn’t dependent on the location of your bank.

What Payoneer does is help you get your money faster, instead of having to accumulate $100 for a cheque to be written.

How about publishing on smashword?

The tax information required is the same, but Smashwords can pay via paypal so you don’t have to worry about creating a US bank account.

Thanks for the tip

Hello, can you please tell me what do I do with W8BEN (Non US) after I receive it from amazonKDP. I live in the UK – Do I have to send it to the IRS or what? When they say download the form does it mean to keep a copy for your self or do I have to send it to the IRS and pay something? It is very difficult to find information about it. Please help

Hi Giza,

The W8BEN is the form you need to fill up to confirm that you are not a US citizen for tax purposes. You should save the form for records but you don’t need to send it to the IRS.

At the beginning of the following year (usually March), Amazon will then issue you the previous year’s tax form, eg, in March 2019 you’ll receive the year-end tax form for 2018. This form (1042-S) is what you use to declare your royalty income to IRS.

As you’re based in the UK, this post will probably help you more: https://selfpublishingadventures.com/tax/

Hi, thank you for the article.

I wonder if there is any hack to avoid the 30% whithholding, what if i pretend living in france ?? it will works or not.

Ha! I don’t think I can comment on that. It’s your good name and reputation (and living) that’s at stake if you try messing with the IRB…

Hi hi,

Since we are already paying tax in USA, do we still need to declare this income in malaysia and pay to IRB?

If you are based in Malaysia/ are a tax resident in Malaysia, you would still need to declare this income in Malaysia. Malaysia does not have a double taxation treaty with the USA 🙁

Hi I am from Malaysia and just to make sure again. After we receive the money, we still need to declare to LHDN, so it’s another round of tax from Malaysia Gomen?

Yup, that’s right. Although royalties from books below a certain amount are non-taxable. Do check with a tax agent about that!

Hi. Could Malaysians escape the 30pc witholding tax if we get the EIN from the IRS?

You would escape the 30% withholding tax, but this would make you eligible to pay local taxes to the IRS, depending on where your business is located. Please consult a tax agent to understand the how taxes in the USA work before you do this.

Hi, is there any tax agent that you can recommend for US tax?

Sorry, we don’t.

Which bank do I put under if I am using Payoneer?

Hi Charles, If you are using Payoneer, your Payoneer account will have a page on the bank information that has been assigned to you.

Hi, thanks for info.

If I opt for cheque payment, how long does it take for me to get the cheque through mail based on your experience?

What kind of charges do I have to pay if I deposit into my Malaysian bank account. Also, what are the charges I need to pay the bank to get the cheque cleared?

Thank you.

Hi Salmah, sorry we can’t answer this question as we don’t use cheque payments. Regarding bank charges, it’s best to check with your bank directly as this would probably change from time to time.

Hey Chris. How do I submit the W-8BEN form to Amazon? When I clicked the link, it took me to a .pdf file but there’s not submit button.

The PDF file is just a sample of the standard form so that you can gather the information you need first. To submit to Amazon, log in to your KDP account, go to My Account > Tax Information and fill up the web form there.

Thank you Anna. Sorry, I misread the comments, thinking that your name is Chris. I apologize for my silly mistake.

hi, i tried finding the form in Tax Information under my kdp acc, but I couldnt. Can you assist me on this?

It’s under My Account > Tax Information. KDP actually gives you an online form to fill up, so it won’t look exactly like the screenshots in this post (which is from the manual PDF form). The information requested is the same, though!

Hi so overall for us Malaysians, does amazon KDP only tax us 30%? Because I read that on other websites, if you’re publishing a book on Amazon Kindle Direct Publishing as a non-US person, on top of the 30% cut taken by Amazon, Amazon will also automatically withhold 30% of your royalties for tax purposes. And all you left with is a meager 40%…

So is it true?

Does KDP only tax us 30%? Yes.

Do they take 30% before that as well? Yes. But that’s not a tax, that’s their profit margin.

There are two separate things at play here.

1. The standard royalties that Amazon Kindle pays is 70% of list price. This is standard across the board, no matter where you live. This is NOT tax. 30% is Amazon’s cut for selling your ebook since they don’t charge you any upfront costs.

2. The second cut is for tax purposes. Malaysia doesn’t have a tax treaty with USA, so there is an automatic withholding tax of 30%.

So technically you only receive 70% of 70%, so approx 49%.

Hi, I already have my own KDP account. Is it possible if I create a new account for my wife using the same address and sharing the same wifi? 🙂

Hello, may i know how to open the Payoneer account, and where to put the account information once we have it?

Select register on the Payoneer website and fill in your information. It will ask you for some identification documents for verification, usually your IC/Passport and/or a local bill.

Once you have the US bank account information on Payoneer, you’d go back to your KDP account and fill it in under “Getting Paid”.

Hi. I’m a student, still studying at university. Does the Payoneer require a charge? I mean, I want to publish e-book with KDP but how if I don’t get income and all. And once I already fill the form W-8BEN, do I need to submit it somewhere?

Payoneer doesn’t charge you upfront, but it does take fees when any money is transferred. We currently recommend looking at Wise.com as that has lower transfer fees than Payoneer!

If you’re publishing with KDP, you can fill and submit the W-8BEN directly on their website.

Hello, not sure if you’re still responding to this post but I do have a few questions about kdp. I’m a Malaysian who used to live in Canada. I still have my Canadian account and am a PR there. Could I use my Canadian bank account and address to register my kdp account?

Yes, you definitely can! It’ll probably be easier than registering with a Malaysian account.